Ein erfolgreicher Immobilienkauf in Florida basiert auf Vertrauen und Erfahrung

Finden Sie Ihre Immobilie in Florida

Immobilien

Wir analysieren den Immobilienmarkt Florida exakt nach Ihren Wunschkriterien und listen Ihnen alle verfügbaren Immobilienangebote. Möchten Sie Ihre Florida Immobilie verkaufen, ermitteln wir für Sie den marktgerechten Verkaufspreis.

Neubau

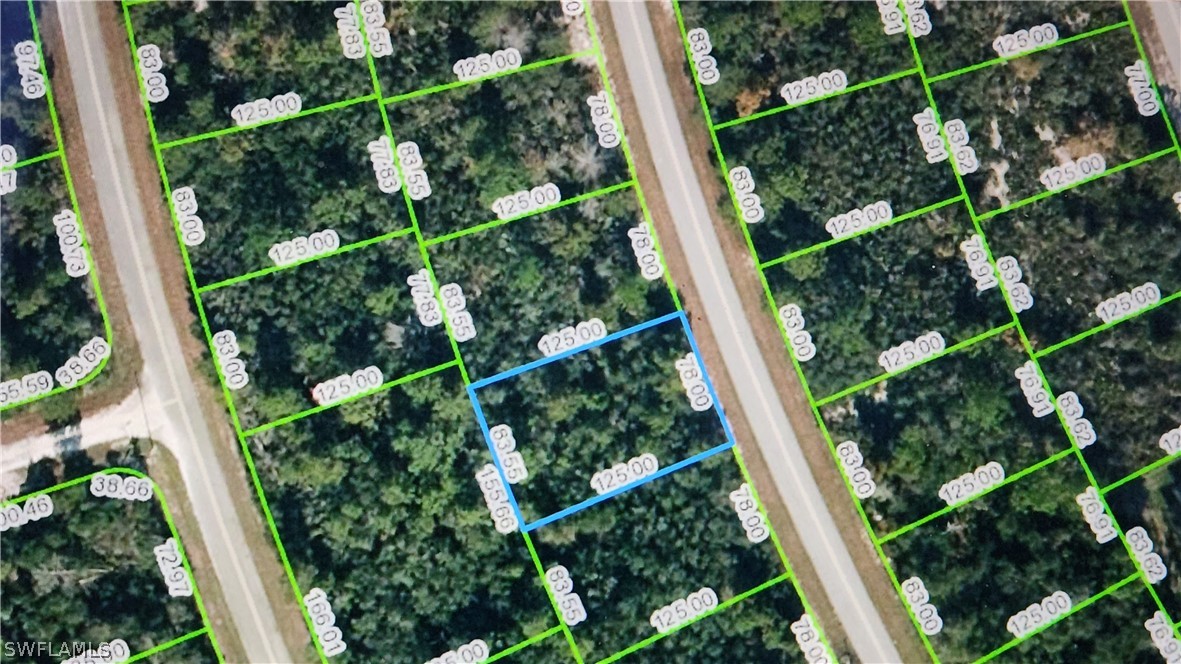

Wir unterstützen Sie bei der Auswahl und dem Ankauf Ihres Grundstücks in Florida. Anschließend begleiten wir Sie von der Planung bis zur Realisierung und Endabnahme (certificate of occupancy) Ihres Neubaus in Cape Coral/Fort Myers/ Sanibel Island.

Hausverwaltung

Wir betreuen Sie auch nach dem Ankauf Ihrer Immobilie in Florida und übernehmen für Sie die internationale Vermarktung Ihres Ferienhauses. Die lokale Hausverwaltung in Cape Coral übernimmt für Sie alle anfallenden Unterhaltungs- und Kontrolllaufgaben.

Featured Listings

Ferienhäuser Cape Coral, Florida

Mieten Sie für Ihren wohlverdienten Floridaurlaub ein Ferienhaus in Cape Coral, Florida. Wir bieten ein exklusives Angebot von gepflegten Ferienhäusern und Ferienvillen aller Kategorien und Stilrichtungen - von günstig bis luxuriös. Während Ihres Aufenthalts steht Ihnen die Hausverwaltung vor Ort als Ansprechpartner stets zur Verfügung. Buchen Sie einfach online.

Boot mieten Cape Coral, Florida

Buchen Sie mit Ihrem Ferienhaus in Cape Coral gleich Ihr Boot. Ab 3 Tage Mietdauer wird es Ihnen direkt an den hauseigenen Bootsanleger geliefert. Ein spezieller Bootsführerschein ist in Florida nicht nötig. Sie müssen lediglich 21 Jahre sein und einen gültigen Autoführerschein besitzen. Alle genannten Bootspreise Cape Coral sind Komplettpreise einschließlich Steuer - keine versteckten Kosten.

Unser Team

Sunbelt Realty Inc. ist seit 1996 das #1 CENTURY 21 Immobilienbüro in Florida. Eine Vielzahl von Awards bezüglich des Kundenservice und der Zahl der Immobilienverkäufe dokumentieren diese Spitzenstellung in Florida. Das Elite Team von Sunbelt Realty zählt zu den TOP-Teams in Florida und garantiert einen erstklassigen Kundenservice. Die Kundenbewertungen sprechen für sich.

Welche Gründe sprechen für einen Immobilienkauf in Florida?

- Ein Immobilienkauf in Florida bietet ein sehr gutes Preis/Leistungs-Verhältnis

- Der Immobilienmarkt in Florida bietet ein großes Angebot an hochwertigen Immobilien in Top-Lagen

- Aufgrund des günstigen Wechselkurses sind Immobilien in Florida für Europäer äußerst interessant

- Ein niedriges Zinsniveau in den USA und Europa begünstigt eine Immobilienfinanzierung in Florida

- Florida ist einer der am stärksten wachsenden Bundesstaaten der USA

- Florida als international gefragtes Urlaubsziel macht Ferienhäuser lukrativ

- Innerhalb der USA ist Florida ein bevorzugter Altersruhesitz vermögender Amerikaner

- In den nächsten 10 Jahren gehen 75 Millionen Amerikaner in den Ruhestand

- Temperaturen von ca. 25° C sorgen für ein ganzjährig mildes Klima

Wohnimmobilien, Gewerbeimmobilien, Unternehmen, Grundstücke, Renditeobjekte

Wir unterstützen sie bei der Suche und Finanzierung von Florida Immobilien - von Luxusimmobilien, Wohnimmobilien, Immobilien am Meer bis zu Grundstücken, Unternehmen oder Renditeobjekten in Florida. Wenn Sie eine Immobilie, ein Grundstück, ein Gewerbe, ein Unternehmen, ein schönes Haus oder eine Wohnung auf einem Golfplatz oder ein Renditeobjekt in Florida kaufen möchten, organisieren wir als ortsansässige US-Immobilienmakler professionell die gesamte Akquisition, Kaufabwicklung, Finanzierung und Vermarktung der Immobilie als Ferienhaus.

Wir sorgen in Absprache mit unseren Kunden für die komplette Objektausstattung von der Möblierung, Dekoration bis zum Toaster - ready to move in. Wir übernehmen auch die Baubetreuung für den Immobilien Neubau, Umbau oder Ausbau Ihrer Florida Immobilie. Service von A-Z ist unsere Unternehmensphilosophie. Wir verfügen über zahlreiche Referenzen.

Wir vermitteln ein Top-Angebot an hochwertigen und luxuriösen Ferienhäusern in Cape Coral für einen entspannten Urlaub, einschließlich Bootsvermietung. Mieten Sie für Ihren nächsten Urlaubsaufenthalt eine hochwertige Villa oder ein Haus mit Pool und Bootszugang zum Golf von Mexiko.

In unserer Immobiliensuche finden Sie alle Angebote des Multiple Listing Service Florida (MLS).

USA:

USA:  E-Mail:

E-Mail: